China has experienced an unprecedented urbanisation, which is accompanied by a substantial increase of the building stock during the last few decades. Currently, building energy consumption accounts for about 30% of the total energy use in China. Thus, the central government has paid increasing attention to measures addressing energy consumption and associated emissions reduction from the building sector. During the last decade, the Ministry of Housing and Urban-Rural Development has made very progressive achievements in promoting building energy efficiency, visible in new energy efficient-building construction, existing building energy efficiency retrofitting, large-scale public building energy management, green building development, and renewable energy applications in buildings.

Buildings Tab Buildings Tab |

Policy Tab Policy Tab |

Appliances Tab Appliances Tab |

|---|---|---|

| In the Buildings section, you will find an overview of the building sector, information on the bigEE Strategic Approach in China, country specific recommendations, and Good Practice examples from the various regions of China. | The Policy section will provide to you an overview and analysis of key policies and programmes the government of China has adopted to promote energy efficiency in buildings and appliances. | The Appliances section will illustrate national best available technologies (BAT), non-BAT appliances typically used in China as well as analyses of the potential costs and benefits of energy efficiency improvements. |

| Total population | 1,339,724,852 |

| Size | 9,571,302 km² |

| GDP(PPP) (2012 est.) | $12.382 trillion |

| GDP(PPP) per capita (2012 est.) | $9,146 |

| GDP real growth rate (2012 est.) | 7,8 % |

China is the most populated in the world and has a fast-growing economy with a corresponding growing energy demand.

To face this demand and associated pollution risks, which according to a World Bank study amount to about 4.3% of the Chinese GDP (World Bank 2007) www.bigee.net/s/dsmn41, the Chinese government has incorporated energy efficiency into its five-year plans since the 1980s. In the consequence, since then the energy intensity of the country has decreased by more than 50% (Liao et al. 2007) www.bigee.net/s/ryzvut.

| Existing building area (2010) | 48,6 billion m2 |

| Rate of new construction (2008) | ca. 2 billion m2/a |

| Construction as part of GDP | 6,6 % |

With a growing economy and population the energy demand in the buildings and appliances sector is growing rapidly. The energy demand in buildings amounts to about 30% of the total final consumption (figures for 2010; IEA 2012, p. 379); the residential energy intensity is at 109 kWh/m2 (figures for 2010; IEA 2012, p. 376). With an annual growth rate of 15.5% the building sector is one of the economy’s most dynamic sectors (Kang/ Wei 2005, p. 281). In 2001, the World Bank estimated, that by 2025 half of the world’s building construction will take place in China (World Bank 2001).

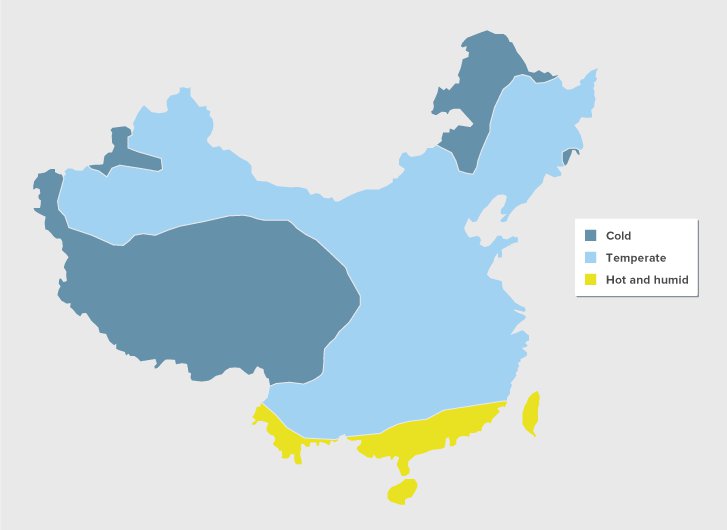

Climate zone definition according to the Chinese Energy Building Standards

The climate classification for the building sector for China according to the building energy standard is divided into 5 distinct zones. These climate zones are divided according to the average temperature both in hottest and coldest months, and adopted cumulative days of the year with average temperature <5°C,and >25°C as auxiliary indicators. These climate zones being, severe cold (1), cold (2), hot summer and cold winter (3), temperate (4) and hot summer and warm winter (5).

| Climate Zone | Typical City or Region | Mean Temp. Coldest Month | Mean Temp. Hottest Month | CDD18°C | HDD18°C | bigEE Climate Zone |

|---|---|---|---|---|---|---|

| Severe Cold | Qinghai | ≤ -10°C | ≤ 25°C | 3800 – 8000 | Cold | |

| Cold | Beijing | -10 – 0°C | 18 – 28°C | 100 -200 | 2000 – 8000 | Temperate |

| Hot Summer – Cold Winter | Shanghai | 0 – 10°C | 25 – 30 °C | 50 - 300 | 600 – 1000 | Temperate |

| Hot Summer and Warm Winter | Hainan | > 10°C | 25 – 29°C | > 200 | ≤ 600 | Hot – Humid |

| Temperate | Kunming | 0 – 13°C | 18 – 25°C | ≤ 50 | 600 – 2000 | Temperate |

Climate zone definition according to the Strategic Approach of the bigEE Project

The climate classification for the building sector within the bigEE project differs from that of the Chinese Building Standard climate definition. The bigEE climate definition is that of a degree-day system. This is based on both the heating degree-days, cooling degree-days as well as the humidity. For simplicity the world’s climate was divided into four major climatic zones, Cold, Temperate (Note: this is not the same Temperate as in the climate definition for China according to the Chinese Energy Building Standards), Hot and Humid and Hot and Arid. Each of these regions or zones has different requirements with respect to heating and cooling energy needs. The focus for energy-efficient measures therefore varies between different climatic regions.

| Climate | Typical City or Region | CDD10 °C | HDD18°C | Humidity hottest month |

|---|---|---|---|---|

| Cold | Qinghai | < 1000 | ≥ 1000 | n.a. |

| Temperate | Shanghai, Beijing | ≥ 1000 | ≥ 1000 | n.a. |

| Hot - Dry | n.a. | ≥ 1000 | < 1000 | ≤ 50% |

| Hot - Humid | Shenzhen | ≥ 1000 | < 1000 | ≥ 50% |

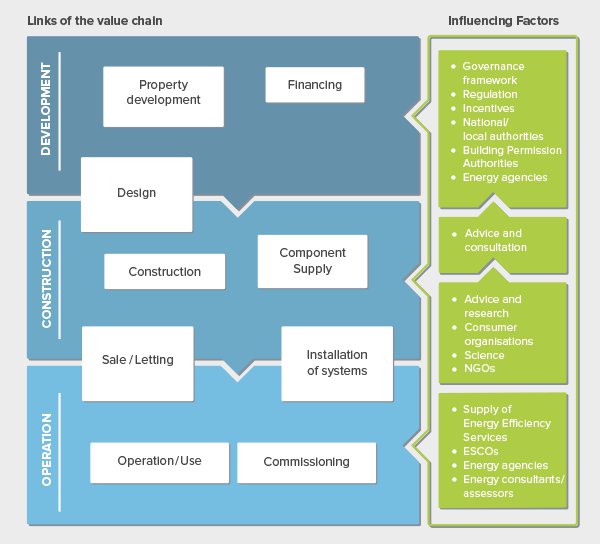

The construction of a new building is an extremly complex process. In each of the three main phases of development, construction, and operation, there are several interlinked steps in the value chain that have to be co-ordinated. This process involves a correspondingly large number of different market actors, the most relevant of which are architects, developers, financiers, builders, contractors, component suppliers, and last but not least investors, building owners, tenants, and individual users. In addition, there are also some actors that are not part of the value chain itself, but nevertheless play important roles in influencing market decisions, such as public authorities, energy agencies, and energy service companies (ESCOs) – to name just a few.

Processes for energy-efficient building refurbishment are quite similar to new build and involve many of the same actors, although they normally exclude the tasks and actors of property development and sale or letting. Such renovation processes and actor constellations are thus almost as complex as those for new build.

The following figure illustrates the distinctive complexity of the building sector and shows how the different phases, tasks that form the links of the value chain, and respective influencing factors interact.

| Property development | Property development companies (Social) Housing companies Investor-occupier |

|---|---|

| Financing | Banks Equity funders Public-private partnership (PPP) Insurances Property valuers |

| Design | Architects Engineering consultants |

| Component supply | Component manufacturers Wholesale and retail |

| Construction | General management companies Construction companies and contractors Manufacturers of pre-fabricated houses |

| Installation of systems | System suppliers Installation contractors |

| Sale/Letting | Property development companies (as sellers or landlords) Manufacturers of pre-fabricated houses Housing corporations Real estate agents Landlords/landladies Buyers, tenants |

| Commissioning | Commissioning providers Engineering consultants Facility managers |

| Operation/Use | Investor-occupiers (as developers or as buyers of completed buildings) Landlords/landladies Tenants Employees, customers, visitors, guests etc. Facility managers |

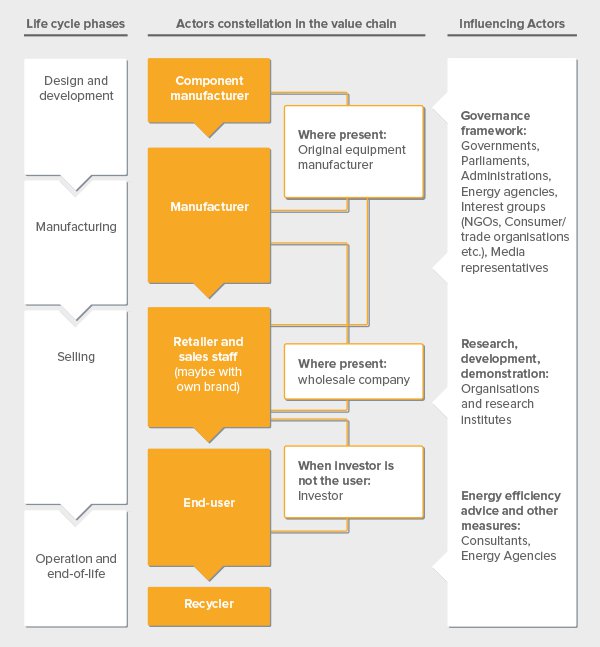

In each of the main life-cycle phases of an energy-efficient appliance, from development to recycling, there are several interlinked steps in the value chain that have to be co-ordinated. Consequently, this process involves a large number of different market actors like manufacturers, retailers, wholesale companies, investors, and users. As with buildings, there are also some actors that are not part of the value chain for appliances itself, but nevertheless have an important role to play in influencing the decisions of the market actors - for instance: public authorities, energy agencies, research institutes, and interest groups.

The following figure illustrates how the relevant actors in the appliances value chain interact in the different life cycle phases of appliances. The arrows demonstrate the supplier relations. On the right side of the figure, you can see the influencing actors, which have possibilities to influence the design, manufacturing, sale, or use of the product. Different actors can influence the energy consumption of appliances via the governance framework, research and development activities or energy efficiency advice and other measures.